What We Do

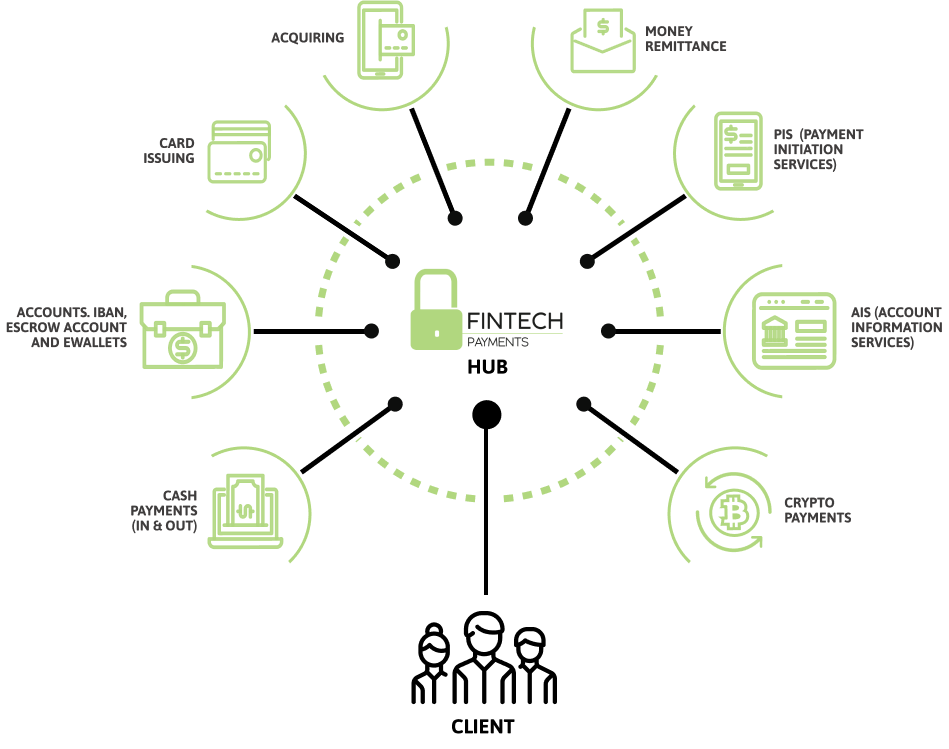

Fintech Payments

On the one hand, consumers need convenient, fast and secure models. On the other hand, companies need to adapt to the demands in order to diversify and improve their business model

So, in order to help businesses to create a secure customer journey, we have developed the Fintech Payments Hub.

Our solutions

Fintech Payments Hub

Fintech Payments Hub is a technological platform that integrates all payment services regulated by the European Payment Services Directive (PSD2) and makes them available to our customers, so that they can adapt and configure them to suit their business model and, in particular, their payment and collection flows, whether they are collecting payments from their customers or paying their suppliers.

ACQUIRING

Accept card payments in any jurisdiction in the world. Thanks to our network of partners, we can offer you simple solutions for complex collection and payment processes. You can also add currency exchange functionalities.

A second-hand car buying and selling company wants to integrate several payment methods both in its digital platform and in its physical points of sale throughout Europe. In addition to connecting virtual and physical POS for card payments, they want to charge their customers via BIZUM.

PIS (PAYMENT INITIATION SERVICES)

USE CASE:

A stock brokerage firm with a digital platform needs to collect very high average tickets (above 1 million euros) from its customers but a card payment transaction would make this transaction inefficient due to the high costs of the payment schemes. To this end, the firm wishes to incorporate a payment initiator into its platform by limiting transactions to a certain maximum amount, covering more than 20 countries across the European Union.

CASH PAYMENTS (IN & OUT)

Accept or collect cash in various currencies and with different currency collection or delivery points.

USE CASE:

Electricity company wishing to facilitate the payment of its bills in person at sale points other than its offices, e.g. in supermarkets in smaller towns.

CARD ISSUING

A multinational company wants to issue an expense card to all its employees deployed in the European Union and Latin America. In addition to the control of current expenses, the company wants to reconcile these expenses with its ERP accounting system.

AIS (ACCOUNT INFORMATION SERVICES)

A micro-lending platform wants to incorporate a bank account information solution in order to access its customers’ banking information and be able to score their collections and payments in real time. Thanks to this information, the company will be able to profile the risk of its financing operations in a more approximate way, as well as carry out campaigns for other financial products, profiling its customers according to their consumption and savings habits.

ACCOUNTS. IBAN, ESCROW ACCOUNT AND EWALLETS

USE CASE:

A pharmaceutical association that wants to provide an IBAN to each associate (pharmacy owners) to manage their payments to suppliers, financing of medicines by the association, as well as other collection and payment processes related to their activity.

MONEY REMITTANCE

A company specialized in exporting fruit to several continents needs to reduce the fees it pays for international transfers. The company’s CFO came to us to provide more efficient remittance solutions by adding several local remittance companies to reduce the high costs charged by his traditional bank.

CRYPTO PAYMENTS

An e-commerce wants to charge its customers via Bitcoin, Ether and Litecoin. With a very simple integration, the customers of this online shop will be able to make purchases using their usual cryptocurrency wallets, enjoying the benefits of the crypto universe now also when shopping online.

Our Technology

SECURE

PCI compliance, card capture.

ISO 27001 and 9001, security and processes.

360º VISION

1 single integration where to manage and control all means of payment and related operations.

DOCUMENTATION

Multilingual online manual.

Examples of different programming languages. SandBox environment for integration processes.

EASY INTEGRATION

REST services, easily integrated with any technology.

INTERNATIONAL

Worldwide coverage for both payment methods and services.

AGNOSTIC

Fintech PaymentS Hub independent of connected providers. Easy migration with no technological impact.

Our Method

Our method is based on understanding and advising the customer from the first contact, analysing their payment needs and identifying the proposed problems and possible solutions.

Thus, our methodology combines two concepts that define the way we work: our knowledge of how the world of payments and “fintech” works, which allows us to provide advice with guarantees, and the technology we have, which gives us great flexibility to adapt to the type of solutions that our customers need.

1. ONBOARDING

Our onboarding team creates the profile of our new clients from the form we send in our first communication, together with a mutual NDA so that all information has the highest guarantees of confidentiality.

2. STATUS REPORT

In this stage we proceed to issue a report with the needs detected, as well as with the possible payment service providers to be integrated into our client’s platform or, if it does not have any type of technology, we also include the possible technological elements to be developed or implemented.

3. Identifying payment service providers

Based on the initial status report, we proceed to organise and hold meetings with each of the payment service providers identified.

4. Closing the solutions to be integrated

At this point we confirm the payment service providers to be connected to our client’s platform.

5. Regulatory framework (optional)

Thanks to our legal partner, all the necessary regulatory framework can be reviewed by a specialised payment services team.

6. Technical integration

Once our clients have concluded the relevant agreements, we proceed to carry out the necessary integration and testing work, so that our client can go to market with all guarantees.

7. Live mode!

Once the testing phase is successful, we go to market.

8. Ongoing technical and business support

Going to market is just a milestone, the important thing is to stay there and continuously improve. That is why we accompany our customers all the time in order to anticipate possible strategic changes in the development of the payment solutions used.